Author Archives: Jane Benton

Extreme Competition in Tauranga

When G3 launched in 2009 we aimed to do it with a bit of a splash and so of course we held a launch party! What was memorable about that night…..the food (and bubbles) of course! We were fortunate to have Amanda Lowry cater the event and she did us proud.

Many of you who live in Tauranga will know that in March 2013, Amanda had a surfing accident which left her in a wheelchair. Amanda and her partner, Gemma, have two gorgeous daughters Lola who was three and Ziggy who was only 6 days old at the time of the accident. Amanda had some lump sum Total & Permanent Disability Cover and a Private Medical Insurance policy through us which helped financially, along with ACC. Having less financial pressure at such a time undoubtedly helps, but this is not an insurance claim story!

Many of you who live in Tauranga will know that in March 2013, Amanda had a surfing accident which left her in a wheelchair. Amanda and her partner, Gemma, have two gorgeous daughters Lola who was three and Ziggy who was only 6 days old at the time of the accident. Amanda had some lump sum Total & Permanent Disability Cover and a Private Medical Insurance policy through us which helped financially, along with ACC. Having less financial pressure at such a time undoubtedly helps, but this is not an insurance claim story!

Over the years the whole family has shown huge resilience and whilst we know there will have been some very dark and distressing times, Amanda’s ongoing achievements and self-determination have been an inspiration. Which is why, when Amanda asked us to be a sponsor of the inaugural Bayfair Festival of Disability Sport, to be held on the weekend of 24th and 25th of March at the ASB Baypark Arena, we got on board straight away.

This is the only disability multi-sport event in New Zealand featuring Wheelchair Basketball, Wheelchair Rugby, Boccia and Blind Sport.

Amanda is the Ambassador for the event and says “Sport is a powerful vehicle to bring change to everyone, but our particular passion is inspiring and facilitating those born with, or who have acquired a physical disability to get active and involved in sport and the community in general.

There are 34,000 people with a disability in the Bay of Plenty alone and we want to create a safe and inspirational opportunity for physically disabled people from across New Zealand to get together with other athletes, friends and families and celebrate and compete (these sports are super-competitive!)”

Please follow the link to the event’s website to find out more – on Sunday there is the ACC Paralympic open day – with some Paralympians attending and there will be lots of information and demonstrations. There are also tickets still available to the Saturday Awards Celebration event, which sounds amazing, and we encourage you to go and cheer these guys on if possible.

SHARE THIS POST

What are you planning for?

And the winner is … who?

Marc Lore was a successful businessman and entrepreneur by pretty much any standard. He originally worked in the finance industry, and in 2001 he sold his first company to the Topps Company. He set up a new company selling diapers and baby care goods in 2005, and it expanded over the next few years. In 2011 he sold that company to Amazon for US$545 million.

In 2014 he founded a new company, Jet.com which was an online shopping club competing with the likes of Amazon. In 2016 Jet.com was sold to Walmart for over US$3 billion, and Marc Lore agreed to work for Walmart as Chief Executive Officer of its e-commerce business.

Given his tremendous success, you would expect that Marc Lore would be happy with his lot, but surprisingly that wasn’t the case. After he sold his diapers business to Amazon, he made enough money to ensure that he didn’t need to work again, or that his family would ever want anything. This should have been a happy occasion, but instead Marc Lore felt depressed. He even described his feelings upon completing the sale as similar to mourning.

He isn’t the only one to experience this surprising reaction. Markus Persson was another entrepreneur who created the wildly popular game called Minecraft. He sold the company that owned Minecraft to Microsoft for US$2.5 billion, and is now a billionaire, purchasing an 8-bedroom, 15-bath mansion in Beverly Hills for US$70 million. For fans of old TV shows, this seems to be very similar to the plot of the Beverly Hillbillies, except swapping a Swedish games developer for the more well-known Clampett family.

Markus Persson has explained that he “never felt more isolated” after selling his company and making his fortune. If it is any consolation, the fictional Clampetts also had serious problems adjusting to their new found wealth, and the entire TV show is premised on that issue.

Achieving your dreams

So why is it hard for people to adjust?

For the fictional Clampetts, it was adjusting to a new lifestyle of opulence and extravagance from their previous dirt poor existence.

For Marc Lore, it was different. He was wealthy already and said his reaction was due to the loss of purpose. He had invested so much time and energy into building his companies, creating a specific and unique culture, making key decisions and watching it grow into a flourishing business. When he sold that business, he lost that purpose and the money he received did not compensate for the loss of purpose.

Markus Persson had a similar reaction, and explained that when he received his massive payday, he ran out of reasons to keep trying, and like the Clampetts, found interacting with other people was much harder due to his wealth.

For the rest of us?

Very few people will ever be in the position to receive such massive windfalls, so it is reasonable to question whether there are any lessons that would be relevant to a New Zealand investor.

The experiences noted above can be applicable to most people because it can all be traced back to a common feature – people mistaking wealth for goals.

In our trio of Marc, Markus and the Clampetts, each of them make life decisions based on obtaining the best financial outcome, rather than looking at the best outcome for them personally. Presumably they were thinking that obtaining a large amount of money would provide them with the ability to achieve their goals. As it turns out, money would not allow them to meet their goals so the decision to maximise their wealth had the effect of limiting their ability to achieve their goals.

If they had known their goals and focused on achieving them, they very well may have made different decisions. This isn’t to say that they wouldn’t have received massive payments, but perhaps they could have made a few tweaks to their decisions.

For Marc Lore and Markus Persson, perhaps this would include a provision that they maintained some involvement in the company they sold. For the Clampetts, perhaps they would be happier if they had negotiated the right to live on a portion of their land or received an equivalent amount of land elsewhere (along with a suitably large payment).

For most other investors, this means knowing what your goals are and making decisions to achieve those goals. Although this sounds easy, it can get quite tricky to implement.

About those goals…

We’ve already gone through the New Year and the recurring theme of making resolutions to improve your life. Those resolutions could be to improve your fitness and general health, lose some weight, work harder or relax more, or to improve your financial position.

Money can help achieving some of these resolutions – you may not be able to buy fitness, but you can pay for a gym membership and personal trainer who can increase your odds of getting fitter. Therefore you can see that money doesn’t make you happy but it can give you more choices that could improve your chances of happiness – assuming you make the right choices.

The right choice needs to be one that achieves one or more of your goals, but you should factor in issues such as:

- Flexibility – A sporty two door coupe may be a great dream car for a 25 year old, but would be completely impractical for a 45 year old with three children. We can change our minds and our circumstances can change, so you need to be able to adapt.

- Timeliness – having enough wealth to afford first class travel each year may be a fine goal, but if that means you only start travelling when you are 80 years old, it may be better to amend the goal.

- Achievable – do you know how likely it is that you can achieve your goals, and how much certainty do you have in that assessment? You need to set goals that can realistically be achieved, but shouldn’t set them so low that you deprive yourself of opportunities. Likewise the goals should not be set so high that it is improbable that you will achieve them. In both cases you should be able to reliably measure your chances of achieving those goals.

This is where it pays to look at any resolutions you have made. Were those resolutions serious attempts to improve your life, health or financial wellbeing, or were they more akin to impulse purchases that were unlikely to have a meaningful impact?

What else should I consider?

In December 2017, the Financial Services Council released a research paper[1] that looked at the attitudes and expectations of older New Zealanders, and tried to understand what wealth is being taken into retirement. They key findings of the report were:

- Nearly all older New Zealanders will be living on the New Zealand Superannuation pension alone after just 10 years.

- Nearly 4 in 10 of the elderly regret not having more financial advice.

- There was a $218 average after tax weekly gap between what retired New Zealanders need to live comfortably and what they actually have. On average, those over 65 think they need $655 a week, but only have $437. The gap will be larger for some, especially if they still have a mortgage or are renting.

The paper also noted that savings and other assets were rapidly used by New Zealanders when they retire, which indicated a need for education on what investment options are available during people’s working lives. Also, wealth tended to be concentrated in a few asset classes, again indicating New Zealanders could benefit from greater knowledge of potential investment types.

54% of 65+ homeowners planned to sell their home to help fund their retirement, but the paper noted that income from selling this asset was only expected to last 3.3 years (presumably because most homeowners were downsizing or moving to a retirement village and used the bulk of the proceeds to fund that purchase).

The paper suggested that its findings send a message to those still working to make the most of opportunities to grow their wealth and increase their sources of income.

This is where a qualified financial adviser can assist. They will work with you and take into account your whole situation and unique circumstances. They will tailor a plan to help you achieve your short and long-term goals as well as protect you, your assets and loved ones.

What will an adviser do?

A financial adviser will help you:

- Invest tax-effectively

- Choose the most appropriate investment strategy

- Make the most of your superannuation or KiwiSaver

- Protect your assets

- Protect you and your family

- Plan for retirement.

Importantly, research tells us that the benefits of financial advice extend far beyond measurable financial gains – to improved physical health and well-being and increased personal happiness.

A common mistake people make is believing that financial planning is only about maximising the amount of money they have when they retire – but that’s not correct because while money can certainly help fulfil your goals, simply having more money is not the goal in itself.

Regardless of your goals it’s important to get the basics right so you can lay solid foundations that enable you to move towards your goals.

How do I know an adviser can help me?

It is reasonable to question whether you will benefit from using a financial adviser. The Financial Markets Authority released a report[2] in 2017 that questioned investors about advice received from financial advisers. The report found that “overall, 87% of clients surveyed were confident they were financially prepared for their retirement”.

Other key findings included:

- When getting advice, people value trust, and clear guidance and communication

- Getting advice builds confidence and helps people make decisions

- Advice is seen as good value for money.

Conclusion

Financial advice can provide invaluable assistance in helping investors meet their goals. Those who receive financial advice tend to be more confident about their retirement prospects and many others regret not getting advice. To make sure you get the most out of financial advice, make sure it is tailored to your particular circumstances and is focused on your goals. Make sure your financial plan helps you achieve the goals you want, with more control, less risk and greater certainty.

[1] Great Expectations – Retirement Realities for Older New Zealanders, Financial Services Council, December 2017

[2] Experiences of financial advice at retirement, Financial Markets Authority, April 2017

SHARE THIS POST

Market Volatility in the headlines

‘How the financial wobble will hit your back pocket’

‘Volatility now the new norm’

‘Keep calm and enjoy the drama of a market meltdown’

‘Bloodbath: New Zealand sharemarket braces for blow’

Wow! Reading this it is a wonder any of us get out of bed in the morning. These are just some of the headlines on the New Zealand Herald website this morning (Source: http://www.nzherald.co.nz/economy/news/headlines.cfm?c_id=34 12th February 2018).

The headline that really caught my eye last week was “Billionaire bashing: Rich listers lose $129 billion in crash”. Such dramatic headlines are just pure scaremongering. Did they really “lose” $129 billion? No – because the Dow Jones closed that day at 23,860. The article noted that that was a 1032 point decline. It then went on to fall as low as 23,425 during Friday but closed the week at 24,205.

Yes, there was a significant loss in value over the week but when do investors actually lose money? For the week ending 9th February 2018 the Dow Jones “lost” around 4.5%. Over the twelve months to that same point, the index gained 18.5%. The emphasis is certainly that short-term volatility needs to be put into longer term perspective.

Globally, share markets have fallen over the past few days, giving back 6% of recent gains. While this has been quicker than the usual decline, the size of the pullback is actually within the “normal” bounds of market behaviour, even when share markets are generally rising. This is something that tends to be forgotten in the media. (Not to mention that most investors have a diversified portfolio, with other investments such as fixed interest and property that smooth the bumps from share markets.)

Investors had been favoured in 2017 with unusually smooth returns, which has fed its way into general public expectations and newspapers’ interpretation of the recent pullback. For 2017, the US share market index (the S&P 500), only had four declines from its peak that were greater than 1%. The largest fall was only 2.8%! This smooth performance, despite a positive economic outlook, is not normal. History suggests that on average, share markets actually have a 5% pullback once per year, and a 10% decline every two years.

Not only is the recent fall well within this “normal” range, but it comes after a strong gain in January, so the S&P 500 index is still up around 1% for the year so far.

How have New Zealand shares reacted?

Closer to home the NZ share market had a quieter start to the new year, and after reopening following the Waitangi Day holiday, fell only a relatively muted 1%. This is quite typical for the local share market in these scenarios, given its more “defensive” nature.

There are still positives in markets

While pullbacks create volatility and fearful newspaper headlines, they often turn out to be buying opportunities when looking back, once clearer thinking prevails. Looking ahead, our assessment of the underlying fundamentals driving global share markets is that they remain very much in place:

- Economic growth remains positive;

- Business and consumer sentiment is upbeat;

- Interest rates are still supportive; and

- Corporate earnings are still growing nicely.

These key pillars are still driving markets, and it’s not just in pockets of the global economy, but everywhere from North America, to Europe, to Asia. While wage growth and inflation has been singled out in the recent pullback as areas of concern, they both remain well within the range that is generally positive for share markets.

The message remains constant, staying disciplined within your investment strategy is key to achieving your longer term financial goals.

Sources: Booster Financial Services Limited and Jane Benton, G3 Financial Freedom.

SHARE THIS POST

Control what you can and not what you can’t

So the decision has been made and we have a new Prime Minister eager to form our government for the next three years. From what seemed to be a National certainty back in July the tables certainly changed when Jacinda took the lead for Labour.

From an investment viewpoint, such uncertainty is part and parcel of the environment we operate in. There are a multitude of factors that we cannot have any short-term certainty over. These include the performance of companies (and their share prices) and international relations (just look at the tensions between the US and North Korea as well as the ongoing fraught relations throughout Europe following Brexit).

The election here has introduced uncertainty over taxes, superannuation and benefit payments, house prices, employment and the general state of the economy. Yet this week, before any government was formed, we saw the NZX50 reach its highest ever level – who would have predicted that amongst all the uncertainty?

We certainly do not presume to have the answers when it comes to what the real implication of Labour forming a government will be and how that will translate to the wealth of the country and of course, the wealth of individuals through the impact on their portfolios and the shares within.

Nevertheless, there are portfolio managers out there who believed that they did have the ability to judge what markets were going to do once the government was announced, both in the short and long term and have positioned their investments accordingly. But can they always get it right? They might “win” this time with a call on the government, but did they predict where milk prices were going to go this year correctly too? Of course, they couldn’t have forecast the Kaikoura earthquake last year but when it happened, did they quickly adjust their exposure to insurance companies?

For those of you who invest with us, you will be aware of our investment philosophy which uses structured asset class investing. This is a passive type approach to investing. Dictionary.com defines passive as “not reacting visibly to something that might be expected to produce manifestations of an emotion or feeling“. In investment terms that means not making changes to a sound investment strategy due to external forces which you have no control over.

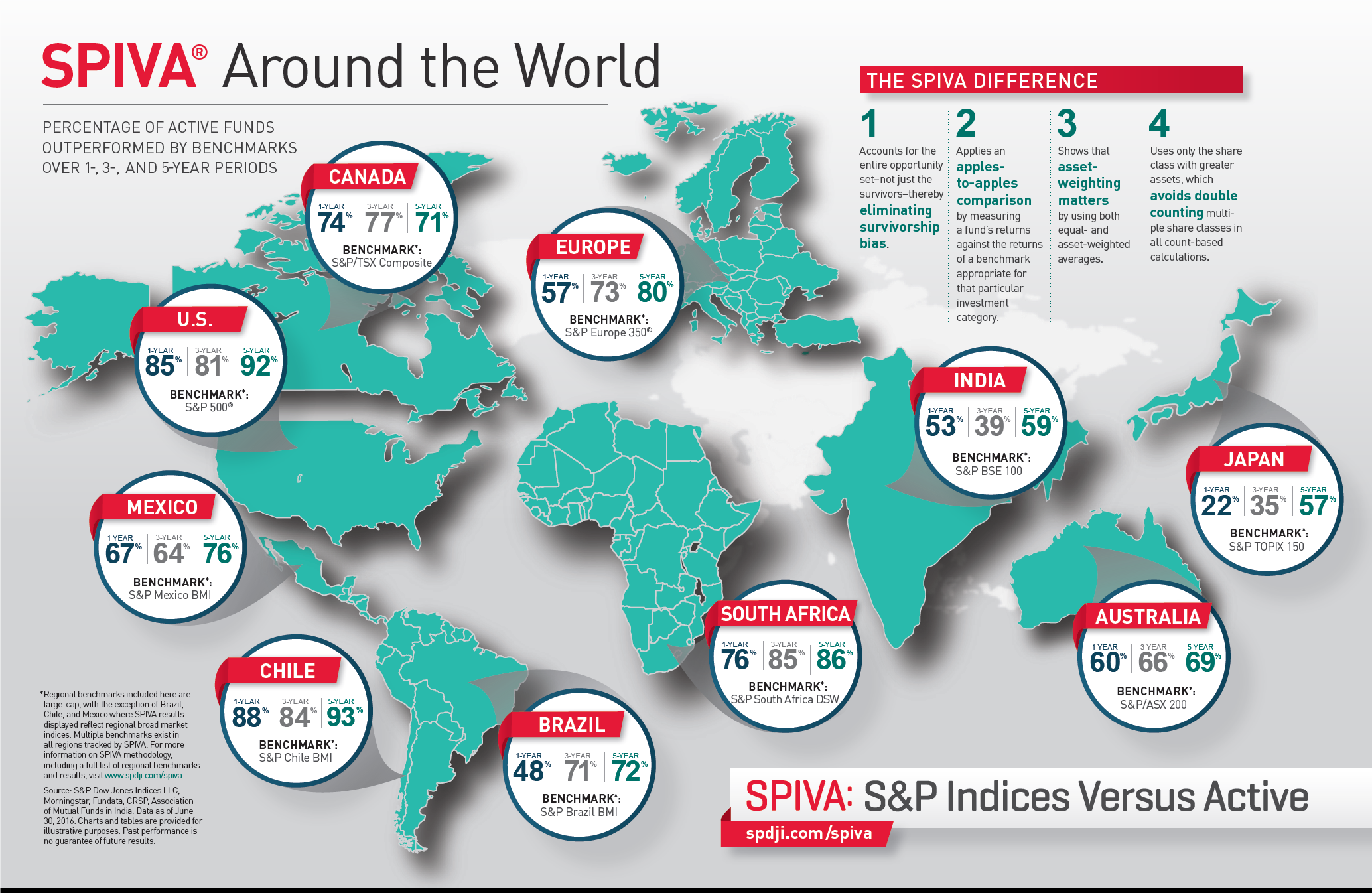

Over the long term, active fund managers have been proven to NOT be able to consistently outperform benchmarks – which are the indices they are investing in – as highlighted in the following graphic:

Sources spdji.com/spiva

What this chart is showing when we look at Australia for example, is that over 1 year to 30th June 2016, 60% of active fund managers under-performed the ASX 200. Over 3 years this increased to 66% and 5 years 69%. Picking a consistently good fund manager becomes almost impossible. You can see this replicated all around the world. Data is coming soon for New Zealand too and we expect to see not too dissimilar results.

With a structured asset investing approach we are relying upon the engine of overall world markets to provide long term returns – something that they have already proved themselves to be good at. It makes little sense to rely upon an active fund manager’s ability to peer into the future and second guess the possible reactions buyers and sellers might have to circumstances which haven’t yet, nor may not even ever, occur. This is just tantamount to adding yet another, risky variable into what is already an uncertain world, and being charged for the privilege! Their crystal balls have been found lacking the consistency needed far too often for us to gamble upon, especially when the marketplace itself provides the longer term consistency anyway.

SHARE THIS POST

Is ACC enough?

We are all aware that if we break a leg, fall off a ladder or slip with the kitchen scissors, ACC will be there to pick up the tab at the medical centre. Whilst there might be a wait, we also know that any hospital treatment or surgery we need is also covered.

For those who earn an income there is also a safety net of an income if our injury causes us to be off work. This is set at 80% of our earnings subject to an income cap of $124,053 (and benefit of $99,242)

However, there continues to be a lot of myths and unknowns when it comes to ACC. So, did you know….

Your injury does not have to occur at the workplace for you to receive a benefit if it causes you to be off work. So that broken bone whilst trying to relive your youth on the rugby field at the weekend is still covered. In fact, even if you suffer your injury whilst you are overseas it may still be covered for treatment once you come home (depending on how long you were away).

If you die in an accident then ACC will also look after your dependents. The fatal entitlements ACC provide can be quite substantial, particularly where young families are involved. As an example:

Jack and Jill have two young children, Tom is 5 and Kat is 3. Jack earns $55,000. Unfortunately, Jack dies in an accident at home. Jill is entitled to a benefit of 60% of 80% of Jack’s salary each year until Kat is 18 (or 21 if she stays in full-time education). Kat and Tom are each entitled to 20% of 60% of $55,000, again until they are 18 (or 21). On that basis, by the time Kat is 18, the family will have received $642,400 in payments.

There are also funeral support payments and other grants available as well as help with childcare costs for under 14 year olds.

Whilst ACC offers huge financial support in times of crisis, it only covers half of the story because it only pays out for accidents and injuries.

In the twelve months from July 2015 to June 2016, ACC had approximately 1267 new fatal entitlement claims, and altogether had 2797 active fatal entitlement claims ongoing. It paid out $83,625,657.

(Source https://www.acc.co.nz/about-us/statistics/#injury-stats-nav)

Yet if we look at just one insurance company’s Life Cover claim stats, 61% of the female claims were related to cancer and only 6% was for accidents, whereas for males, 46% was for cancer and 5% accident related.

(Source: OnePath Life (NZ) Limited (OnePath) total claims paid in the 2015 financial year )

When we talk to families around the financial risk of one of them dying or not being able to work long term there is often an answer of “well I will downsize the house, I’ll work more hours, my parents will help fund the gap” and other solutions. Really? Do you really want to be thinking about selling and moving because you must financially when a loved one has died; do you really want your happily retired parents to now have to support you again? Maybe the increased work hours will not be available, maybe you will not be capable of increasing your workload, you’ve just become a single parent after all.

Our job is to have the hard conversations with you.

Insurance is all about covering the events where we know the financial impact would be major. Your inability to work, pay the mortgage, cover the bills, is one such event and it can just as easily happen through illness as it can injury. In fact, you are more likely to be off work for an extended period because of illness than as a result of an accident. In balance, we tend to recover from accidents quicker than we do from debilitating illnesses.

Checking that your insurance cover is still relevant for your circumstances is as important as having regular health checks – most of us are consistently bad with both. Why not contact us now to discuss what is right for you.

SHARE THIS POST

The Seven Virtues of Process

‘How’ relates to process. It’s not just what you invest in, but the approach you take to investing. This means adopting set guidelines to deal with whatever financial markets, and life generally, might throw at you on the way to where you’re going.

Process is critical for several reasons. Here are seven:

- First, process means setting pre-agreed rules with your adviser to keep you focused on your goals. Without rules, you may be more likely to act on emotion triggered by the headline of the day or whatever other distraction everyone is talking about

- The second advantage of having a process is that it can be tied to broad principles. For instance, agreeing that diversification improves the reliability of outcomes may leave you less prone to chasing the latest hot new stock or sector

- Third, having a process keeps you focused on elements within your control – like dividing your wealth between stocks, bonds, property and cash, diversifying within those categories, rebalancing regularly, and watching costs and taxes

- Fourth, process is repeatable. The focus is on skill and execution, not on luck or providence. Of course, things will always happen that you didn’t anticipate however, your reliance on chance is less with a set process than when you are just winging it

- Fifth, a process acts as a yardstick. When news breaks, having a process can give you pause for thought. “This news is interesting and diverting, but is it sufficient to change how you are proceeding?” your adviser may ask. The answer is usually no

- Sixth, a process can be personalised. Each person is unique, with different tastes and preferences and risk appetites. Perhaps you feel more comfortable with a larger cushion of cash that can be replenished at regular intervals. If this process keeps you on track and helps you better live with volatility then it most likely a good process

- Finally, a process does not have to be set in stone. Circumstances change. Needs evolve. A single process can never incorporate every eventuality. The key point is that the process can be reviewed and adjusted based on experience and what is happening in each individual’s life, not to what is going on externally

Of course, processes work best when they are integrated; otherwise, a minor change elsewhere can throw you off track. Think of what happens in a restaurant if attention to the quality of ingredients, menu and execution in the kitchen is not matched by attention to quality of service in the dining room.

Likewise, an investor who has agreed with his/her adviser on following strong processes around their individual plan will not be served well if those managing their money are not delivering on what they said they would do. In contrast, integrated processes that share and maintain a single vision tend to reinforce each other.

Ultimately, process provides structure for your investment journey. The world will always be complex and uncertain and there will always be a host of potential distractions. However, just having a structure in itself can deliver you a level of reassurance.

With a process, you are less likely to pursue the uncontrollable or unrepeatable – whether wasting time and money trying to second-guess markets or chasing last year’s winners or switching your investment strategy based on whatever is fashionable at any one moment.

Instead of trying to ride your luck or intuition, you are methodically and steadily following a repeatable and defensible process that your adviser has designed with your goals, circumstances and preferences at heart.

Ultimately, paying attention to process makes your destination more achievable.

Source: Jim Parker, Vice President Dimensional 14.09.17

SHARE THIS POST

Have you left a bequest when you die?

Whilst we would like to ensure our families are looked after when we pass on, we want to help spark a thought that maybe including a bequest in your Will to a special organisation that is dear to your heart, could be included too.

Many of us, unfortunately, have experienced someone we care about going through an illness, where the support of a special foundation and its people have been invaluable. These foundations do an amazing job in supporting both the medical and emotional needs of those requiring treatment and importantly, supporting their family members who are going through turmoil too.

Having a Will is vital to ensure you pass on the assets you leave behind to those whom you wish to benefit. Of course, many of us want this to be our families and this is absolutely right. However, as we all know, the statistics show that whilst we are living longer, we are not necessarily living healthier and the medical support and services we are asking for will continue to be an important part of the future. This means that many support organisations need to look to the longer term, to ensure they can continue to commit to helping those needing their expertise.

There are many foundations, and in many guises, that not only support us medically, but support our youth, our athletes, single parents, and many more – all need donations and volunteers to keep operating. Staying with the medical support theme for this article, we thought it would be a helpful reminder of the amazing support that locals in the Bay of Plenty receive from Waipuna Hospice, as it’s not until we need them that we realise how vital having such a link in a community can be. If you haven’t familiarised yourself with what they do, please take a look https://waipunafortomorrow.org.nz/

Although Waipuna Hospice is one local to the Bay of Plenty, there are many similar foundations around the country which need continued financial support if they are going to be there for us in the future.

Maybe leaving a special bequest, to whichever foundation/organisation is important in our lives and for whatever amount we wish, will ensure they are able to continue with their great work well after we are no longer here. Making a difference to those with whom we meet throughout life is important to many of us; so maybe leaving a bequest such as this, can help us achieve a similar legacy when we are no longer here.