If you wanted to invest sustainably in the 1960s, your options were fairly limited. Sustainable investing strategies kicked off with socially responsible investing, where investors could exclude stocks or entire industries from their portfolio based on business activities. For example, if you didn’t agree with smoking you could exclude tobacco production companies.

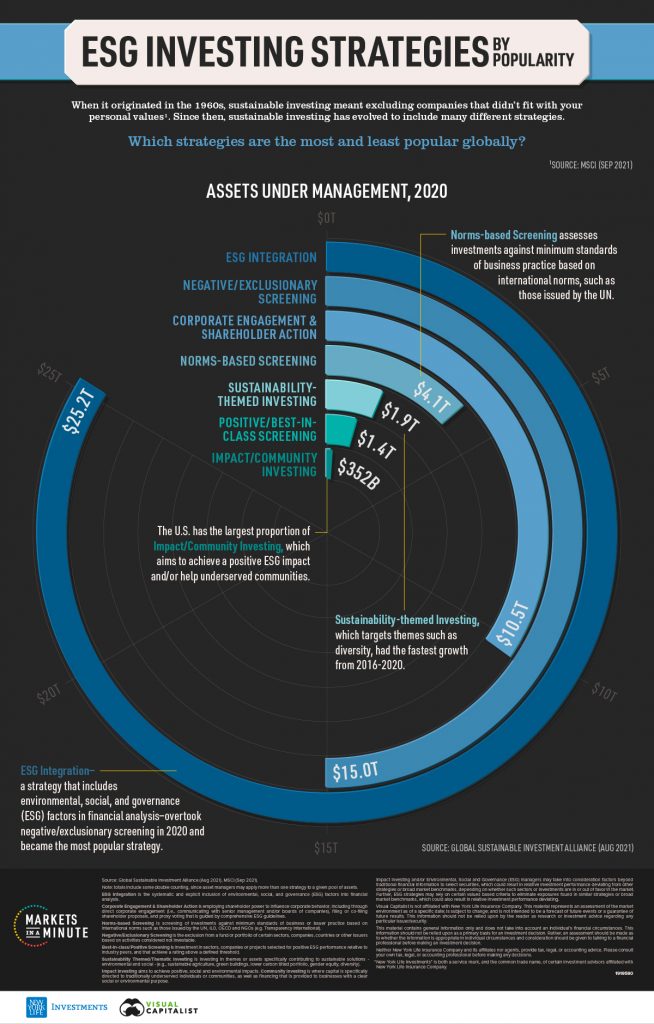

Fast forward 60 years, and investors have many more approaches available to them. From exclusionary screening to ESG integration, which strategy is the most popular? This Markets in a Minute from New York Life Investments shows global assets under management for various sustainable investing strategies, to see which ones are used the most and the least globally.

The Types of Sustainable Investing Strategies

Before we dive into the numbers, it’s helpful to know the definitions of the various sustainable investing strategies. The Global Sustainable Investment Alliance, who put together this data, has classified sustainable investing into the seven core strategies below.

- ESG integration: The explicit inclusion of environmental, social, and governance (ESG) factors into financial analysis

- Negative/exclusionary screening: The exclusion of certain sectors, companies, or countries based on activities considered not investable

- Corporate engagement & shareholder action: Influencing corporate behavior through actions such as shareholder proposals

- Norms-based screening: Screening investments based on international norms, such as those issued by the UN

- Sustainability-themed/thematic investing: Investing in themes specifically contributing to sustainable solutions, such as diversity

- Positive screening/best-in-class: Investment in sectors, companies, or projects with positive ESG performance relative to industry peers

- Impact/community investing: Investing to achieve positive ESG impacts, and/or investing in traditionally underserved communities

While these sustainable investing strategies differ in their approaches, they all require investors to consider ESG factors as they build and manage portfolios.

Sustainable Investing Strategies by Global AUM

Below, we show the global assets under management (AUM) of the sustainable investing strategies in 2020. It should be noted that these numbers include some double counting, as asset managers may apply more than one strategy to a given pool of assets.

| Strategy | Global Assets Under Management (2020) |

|---|---|

| ESG integration | $25.2T |

| Negative/exclusionary screening | $15.0T |

| Corporate engagement and shareholder action | $10.5T |

| Norms-based screening | $4.1T |

| Sustainability-themed investing | $1.9T |

| Positive/best-in-class screening | $1.4T |

| Impact/community investing | $352B |

In 2020, ESG integration overtook negative/exclusionary screening to become the most popular of all sustainable investing strategies. Its rise can likely be attributed to having access to more specific data, such as ESG ratings, that make an inclusive approach easier to implement. In addition, many investors are beginning to understand that considering ESG factors alongside financial analysis may help manage investment risks and increase return potential.

Coming in at third place, corporate engagement and shareholder action has over $10 trillion in assets worldwide. A separate report found that the number of ESG-related campaigns went up in 2021, and the success of investor activist campaigns increased slightly year over year. In fact, 25% of surveyed U.S. boards say they have already tied executive compensation to ESG metrics or are planning to do so.

Impact/community investing has the least AUM globally. It is most popular in the U.S., where 60% of the strategy’s total assets are held.

Growth Rate by Strategy

Of course, the above data reflects that some strategies–like exclusionary screening–have been around for longer periods of time. In contrast, the idea of impact investing was spurred in 2009 after the Global Impact Investing Network was launched.

Another way of gauging each strategy’s popularity would be to look at its recent growth. Here’s the compound annual growth rate of the sustainable investing strategies from 2016-2020.

Sustainability-themed investing saw the highest growth. In 2020, it overtook positive/best-in-class screening to become the fifth most popular strategy. This growth mirrors the rise of thematic investing more broadly, as investors aim to capitalize on long-term structural shifts.

Norms-based screening was the only strategy to see negative growth, likely due to the way it is defined. Some standards falling under this strategy are now minimum and mandatory requirements by various national governments, especially in Europe where regulations have tightened. Because it is expected that these regulations are being followed, investors are least likely to say that norms-based screening is the strategy they use when they classify their sustainable investments.

Spoilt for Choice

Compared to the 1960s, today’s investors have many more sustainable investing strategies at their fingertips. However, with more options comes a new challenge: which strategies should investors consider?

The answer will depend on an investor’s objectives, but this data can give some insight on how other investors are approaching sustainable investing.

Source: https://advisor.visualcapitalist.com/sustainable-investing-strategies-by-popularity/