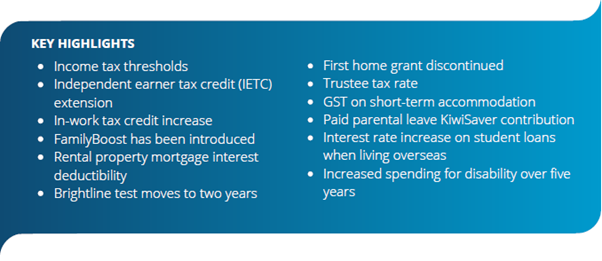

New Zealand Budget 2024

On 30th May, the New Zealand Government released the National Budget 2024. We have

shared below highlights of the Budget which may have implications to wealth creation and

retirement plans, property, and family cash flow decisions.

TAXATION

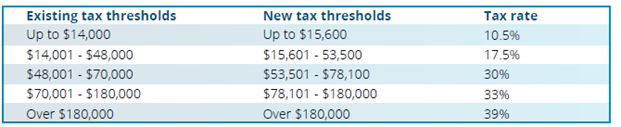

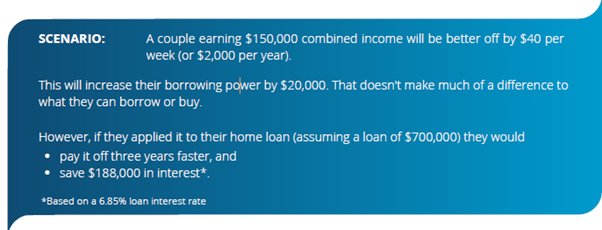

INCOME TAX THRESHOLDS CHANGES

The personal income tax rates thresholds increase from 31 July 2024, excluding the tax rate for income

over $180,000 per annum.

INDEPENDENT EARNER TAX CREDIT EXTENSION

The upper limit of the eligibility for the Independent Earner Tax Credit (IETC) will be extended from

$48,000 to $70,000 per annum. Those earning $24,000 to $66,000 per annum will receive the full $20 per

fortnight credit. The entitlement reduces gradually for income between $66,001 and $70,000. This is

effective from 31 July 2024.

IN-WORK TAX CREDIT INCREASE

The In-Work Tax Credit (IWTC) is a tax for families with dependent children who are normally in paid work

if the annual family income after tax is less than $35,204. The increase is up to $72.50 per week ($3,770

per year) to working families for the first three children and up to $15 extra a week for each additional

child. This is effective from 1 July 2024.

FAMILYBOOST

From 1 July 2024, parents and caregivers will be eligible for a partial reimbursement of their early

childhood education (ECE) fees, up to a maximum fortnightly payment of $150. Reimbursements will be

made quarterly, as a lump sum. The first payments will therefore be made from October.

This maximum payment slowly reduces for family incomes over $140,000 per annum. Families with

incomes over $180,000 per annum are not eligible for FamilyBoost.

PROPERTY

RESIDENTIAL PROPERTY TAX

Effective since 1 April 2024, the ability to claim interest deductions on residential property investments has been phased back in. Between 1 April 2024 – 31 March 2025, 80% of interest can be claimed. From 1 April 2025 onwards, 100% of interest can be claimed.

BRIGHTLINE TEST

The brightline test will be reduced from ten years to two years on all properties from 1 July 2024. This may bring more properties to the market as it removes a barrier to selling. The higher costs of insurance and potential raises in local council rates are detracting property investors.

The changes to the brightline test may help some investors rebalance their portfolios given the impact of the introduction of Debt-to-income (DTI) ratios limiting the ability to borrow in the future.

FIRST HOME GRANT

The first home grant has been discontinued. First home loans are still available, enabling first home buyers to only need a 5% deposit for their first house, based on eligibility criteria.

First Home Loans are issued by selected banks and other lenders, and underwritten by Kāinga Ora. This

allows the lender to provide loans that would otherwise sit outside their lending criteria.

INVESTMENT & SAVINGS

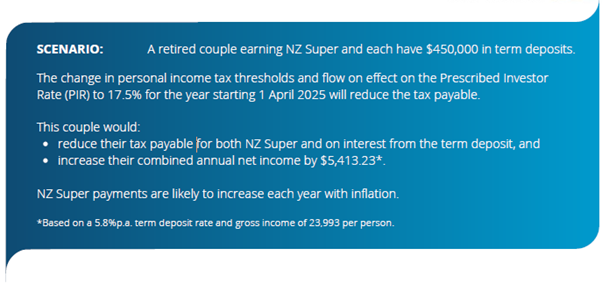

PERSONAL INCOME TAX

The changes to the tax thresholds impact other taxes, including fringe benefit tax (FBT), employer

superannuation contribution tax (ESCT), residential withholding tax (RWT) and prescribed investor rates

(PIR). Clients will need to review the implications with their financial advisers

TRUSTEE TAX RATE INCREASES

The new tax rate for trustees announced last year is effective from 1 April 2024. The trustee tax rate is

39% for the 2024-2025 and later income years. Reviewing trusts and considering using portfolio

investment entities (which have a maximum tax rate of 28%) may minimise the impact of the tax changes

GST ON SHORT-STAY ACCOMMODATION

Clients who be impacted by the new Goods and Services Tax (GST) on short-term accommodation. Online

marketplace operators must collect and return GST of 15% when the service is performed, provided, or

received in New Zealand. This applies to New Zealand and offshore operators. Holiday rental cleaning fees would also be subject to GST. Accommodation used by the customer as their principal place of residence is exempt.

A new flat-rate credit scheme will apply for sellers who are not GST registered. Marketplace operators will

collect GST at the standard 15% rate. They will pass on 8.5% to sellers who are not GST registered. The

remaining 6.5% will be paid to the Inland Revenue Department. These are excluded income for income tax purposes.

PAID PARENTAL LEAVE KIWISAVER CONTRIBUTIONS

Parents who choose to have KiwiSaver deducted from their paid parental leave payments will receive a 3%

Government contribution to their KiwiSaver fund. The contribution would be liable for employer

contribution tax (ESCT). This is effective from 1 July 2024.

NZ SUPER AND DISABILITY SUPPORT

RETIREMENT

The changes to the Personal Income Tax threshold will mean some people receiving NZ Super will get

more in hand if they’re on the ‘M’ tax code. The after-tax rate for NZ Super may increase by up to $4.30

per fortnight. No changes apply if clients are on a ‘S’ tax code.

INCREASE IN SPENDING FOR DISABILITY SUPPORT SERVICES

The government has allocated $1.1 billion over five years to ensure the Ministry of Disabled People

Whaikana can continue to deliver critical disability support services.

This funding is an addition to the government’s more than $2.2 billion per annum investment in disability

support services. The support services include home and community support services, respite care

community residential care, environmental support services, and the High and Complex Framework

Strategy.

PRESCRIPTION CO-PAYMENT

From 1 July 2024, the $5 co-payment for fully subsidised prescription items from publicly funded health

providers will return for everyone except people aged 65 and over, community services cardholders and

under 14-year-olds.

STUDENT LOANS & FUNDING

HIGHER INTEREST RATE WHEN LIVING OVERSEAS WITH A STUDENT LOAN

The Budget 2024 has introduced some significant changes to the overseas student loan system. The

interest rate charged to student loan borrowers who are based overseas will increase by 1% for five years,

taking effect from 1 April 2025. The new rate is forecast to be 4.9%.

FEES FREE SCHEME

The Fees Free Scheme for the first year of study and training will end at the end of 2024. It will be replaced with a final-year fees free scheme starting from January 2025.

APPRENTICESHIP BOOST

The Apprenticeship Boost initiative will continue with ongoing funding. From 1 January 2025, only first-year apprentices in targeted industry areas will be eligible for the $500 per month subsidy.

This information in this document is provided by Financial Advice New Zealand. It may include general information based on online government announcements and Ministry websites. It does not consider your individual objectives, financial situations, needs or tax circumstances. We recommend consulting with a financial advice professional to discuss your specific needs. Find an adviser at financialadvice.nz