Congratulations! You’ve decided to take control of your financial life. You’ve researched your options, asked a lot of questions, and found the right financial advice professional to help you plan for your financial future. As you prepare for your first meeting as a client, it’s likely you have even more questions, and if so, you’re not alone. Many clients of financial advice professionals aren’t sure what to expect, how much to divulge, or even what documents to bring to their first official meeting.

While every financial adviser and adviser practice is

different, most follow a common general framework

based on the six-step financial planning process. The

first step often involves something called a ‘discovery’

meeting, in which you and your financial adviser will

form a basis for your relationship. It’s an opportunity

to build trust, understand problems and priorities,

and establish a roadmap for progress toward your

financial and life goals.

Financial advisers and their business often have an

established process that includes providing a

checklist of required documents and information

they need to get an accurate picture of a your financial situation. While it may seem a bit

overwhelming to share your most important financial details with someone you don’t know well, it’s really no different than consulting with a physician on your health. When you engage a financial advice professional, you are working with someone who is placing your interests first.

THE BIG PICTURE

When your financial adviser conducts a discovery meeting, they will probably ask questions not only about your financial situation, but also about your personal interests, family and lifestyle. Often, a person’s interests, family or lifestyle can influence their financial goals and decision-making, so having a good understanding of your background may help the financial adviser understand your willingness to take on risk, or the triggers that will make you excited or spark your concern. The goal is to help you create a plan that will serve you well in good times or bad, so you always feel confident about reaching your goals.

Thorough financial advisers have a process to securely gather their clients’ information, analyse it, and integrate their findings into a set of recommendations. After receiving and discussing the recommendations from your financial adviser, you will discuss how the recommendations can be implemented, and the role each will play in carrying

out the plan. The more honest and direct you are at the beginning of the relationship, the better your financial adviser can help you create a sound, actionable plan to help

you reach your goals. Although you might be hesitant to discuss embarrassing financial mistakes you have made in the past, it’s important for you to share those so your financial adviser can address any consequences of those decisions.

PREPARE FOR YOUR FIRST MEETING

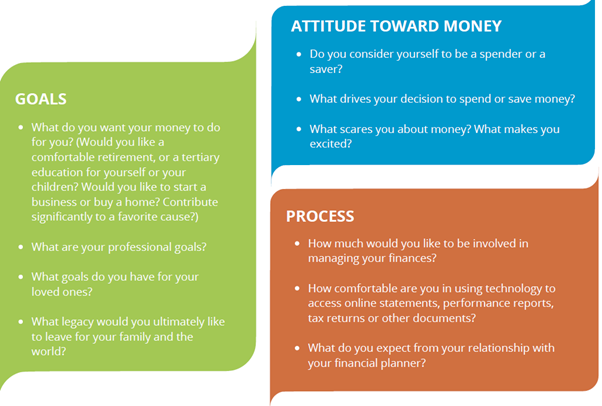

Before attending your first meeting with a financial adviser, take an hour or two to prepare yourself with answers to these potential questions:

GET ORGANISED

Your financial adviser may also ask you to bring certain documents to your first meeting. Those

could include:

- Bank statements from the past year

- Other financial statements, such as loan documents

- Insurance policies

- Tax returns

- Pension or retirement savings account information

- Estate planning documents, such as a will or a trust

- Brokerage statements

A RELATIONSHIP FOR LIFE

Although it may seem like a significant time investment or an emotionally taxing experience, being well prepared for your first meeting sets the tone for a successful, trusting, long-term relationship with your financial adviser. The more your adviser knows about your history, your family, your interests and your financial situation, the better they can help you achieve the financial well-being you and your loved ones deserve.

Some financial advice practices provide a checklist with secure links to enable clients to upload their information prior to the meeting, but you may also bring the actual documents with you, depending on your comfort level. Whichever option you choose, be sure to label your documents and clarify any information that could be confusing.