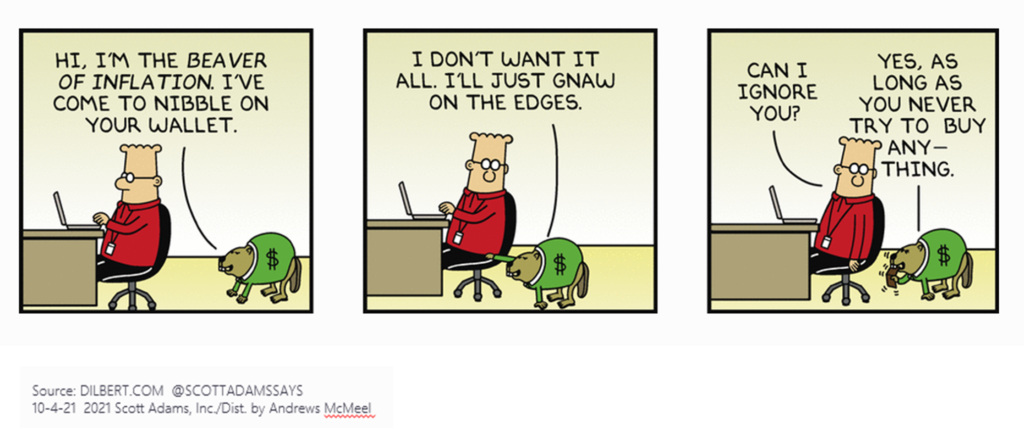

So, what is inflation? Investopedia describes it as “a rise in prices, which can be translated as the decline of purchasing power over time”.

Let’s have a look at the price of a cup of black filter coffee over time:

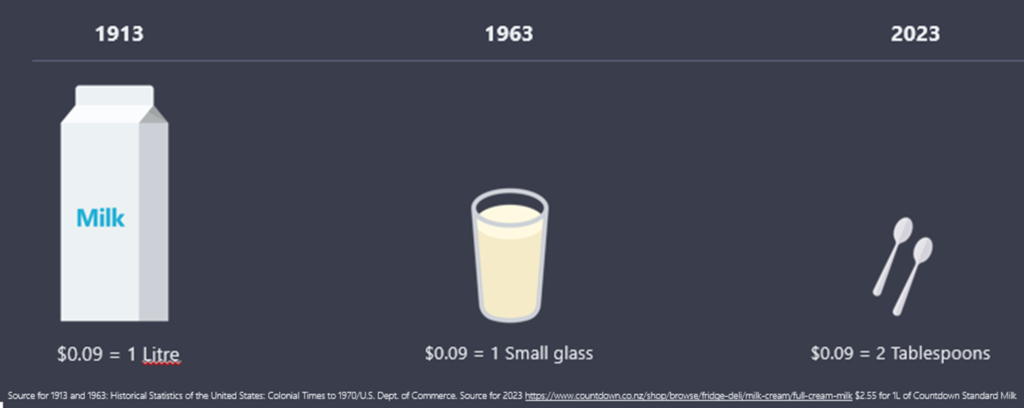

And the price of milk back in 1913 was $0.09 for 1 litre, which in 1963 would have bought you 1 small glass and today in 2023, would buy you 2 tablespoons!!

The inflation tax, by Warren Buffet:

“It makes no difference to a widow with savings in a 5% (term deposit) whether she pays 100% income tax on her interest income during a period of zero inflation or pays no income tax during years of 5% inflation. Either way, she is ‘taxed’ in a manner that leaves her no real income whatsoever. Any money she spends comes right out of capital. She would find outrageous a 100% income tax but doesn’t seem to notice that 5% inflation is the economic equivalent”.

Inflation erodes cash’s value

It appears that now, whilst bank savings interest rates are higher than they were a few years ago, there is a view by some people, that leaving money in cash in the bank, maybe within a term deposit account, is the best option to help grow their money, or at least leave it there whilst they feel the share markets or the economy will get better. Unfortunately this is a misconception. Whilst cash is good for short term savings for specific items, maybe a holiday, car, wedding or home deposit, and especially for emergency purposes, cash is not ideal for growing wealth for the long term. One of the most significant drawbacks of investing in cash is that it fails to keep pace with inflation

If we can receive a term deposit rate of say 6% pa (gross, so before tax), and inflation is running at 7%, then we have already lost 1% of its value in a year, meaning what we can buy today for our money, we will not be able to buy next year. If we are paying tax at the 30% rate too for example, then the rate after tax (net) is 4.2%. Turning this into dollars, if we invest $100,000 in that same term deposit account, then after 30% tax the interest earned at the year end is $4,200. However, whilst we still have the $100,000 in our account, as inflation was 7%, and we only earned 4.2% after tax, then this capital value has gone backwards in real terms to $97,200……..meaning that what we could have bought for $100,000 the previous year, is going to cost us $102,800 this year.

If we continue to invest in cash with the illusion that our capital will remain intact, then whilst on paper it will, in real terms it will not. Just compound the above example over many years and we can see how the value is being eroded year on year by inflation.

Diversification reduces risk

Thinking about what we want from our money in life, now, and over the medium and longer term, is the key, and then having our money allocated to different ‘buckets’ will support our spending needs throughout the rest of our life.

So yes, whilst cash is good for the short term savings we need for specific items and for a ‘rainy day’, having a well-diversified portfolio of shares and bonds will help to keep pace with inflation, grow wealth, and ensure there will be enough to pay the bills and enjoy the life we want over the next 10+ years.

Historically, the average annual return on the stock market, adjusted for inflation, has been significantly higher than the return on cash investments. Shares have the potential to provide us with the capital appreciation needed to grow wealth and maintain its value in the face of rising prices.

Investing solely in cash exposes our wealth to significant risks, such as economic downturns, changes in interest rates, and unexpected expenses that erode the value of our cash. Building a well-diversified portfolio, which typically includes shares and bonds from various industries, sectors and across the world, will reduce this risk. Diversifying worldwide also helps protect our investments from the impact of a single company’s poor performance or a specific economic downturn. Even during market fluctuations, the broader market tends to recover over time, reducing the risk of losing our entire investment.

Property vs shares

Property, like shares, is a growth asset and has historically shown to outperform cash over the longer-term too. However, whilst investing in property provides a rental income for those wanting income, or a potential capital growth in the future, we need to be careful that this income return is actually a good one for the risk we take, after taking account of all expenses for running the property and tax we have to pay. A capital gain can be achieved, however, we need to be mindful of what this gain may be after taking account of all costs during the term of holding it.

The downside of property is that if we need money for a specific spend, then we cannot ‘carve’ a lump sum of cash off of the side of our property, meaning it is illiquid. We would have to wait to sell it to release the cash value, or be forced to sell it (which may be not ideal depending upon property values). Holding a well-diversified quality share portfolio means we can release money when we need it, as this is liquid and shares/bonds can be sold pretty much straight away. Having a combination of both property and shares may be ideal depending upon your goals.

Conclusion

Whilst cash has its place in a well-rounded financial strategy, relying on it solely as an investment vehicle can hinder your long -term financial goals. The erosion of purchasing power due to inflation, limited returns, and the absence of compounding, makes cash less than ideal for wealth creation.

If you come into wealth suddenly, through the sale a property, a business, or an inheritance, then of course put this into cash in the bank temporarily – this will give you time to breath and to seek independent financial planning advice from an expert adviser who can carefully consider your risk tolerance and tailor a plan to suit your goals and tax position. Although shares come with their own set of risks, a well-managed portfolio can help you build wealth and achieve your financial objectives over time.

Charlene Overell 16.09.23