Kiwis who seek out and receive professional financial advice, exhibit good financial behaviours more often than unadvised Kiwis. According to Financial Advice New Zealand report 2021, advised Kiwis are more prepared for retirement, feel better about their finances and are more comfortable making big financial decisions.

Building on the research report from 2020, Trust in Advice, which clearly showed that financial advice and advisers are trusted and highly valued, the Better Behaviours report measures the extent of positive financial behaviours demonstrated by advised Kiwis compared to those who are unadvised.

The independent and comprehensive survey of 2,000 people repeated many questions from the 2020 survey to determine the 2021 Financial Advice NZ Wellbeing Index* and to compare it to the 2020 results. In addition to these questions, we asked Kiwis about their financial plans, what financial products they had, when they last reviewed aspects of each product, and if they made changes. It also asked if they thought those changes would make a long-term difference to their financial wellbeing.

The results are clear – advised Kiwis exhibit better financial behaviours:

– More than two thirds of advised New Zealanders say that advice has led to outcomes such as a better understanding of the risks of their financial plan (77%), a better understanding of how to achieve financial goals (74%), and they are better equipped to actually stick to these financial plans (70%).

– The vast majority of advised consumers say that their advice relationship is meeting their needs. When asked whether the service provided by their adviser met their needs, a strong majority (91%) said yes to at least some extent.

– More than two thirds of advised New Zealanders (67%) say that their financial security has improved at least slightly as a direct result of receiving financial advice. Further to this, sizeable proportions also say that advice has had a positive impact on their mental health (46%), family life (40%), and even on their physical health (25%).

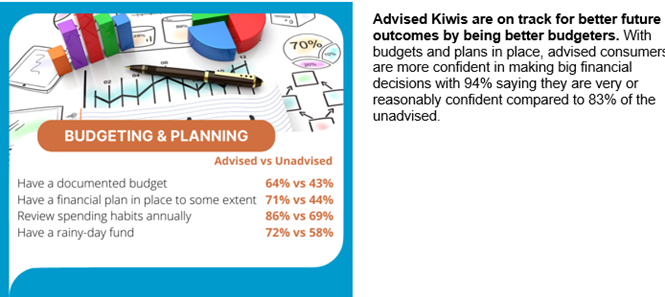

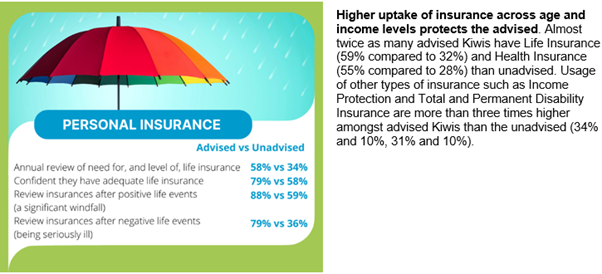

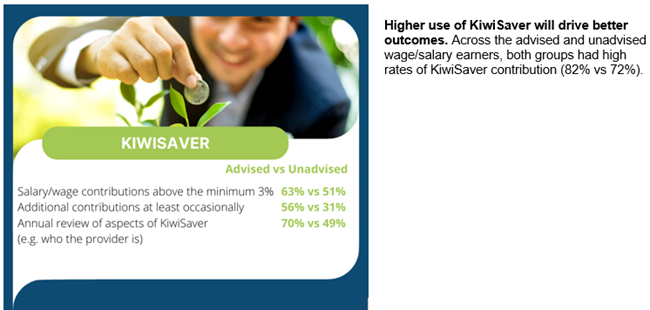

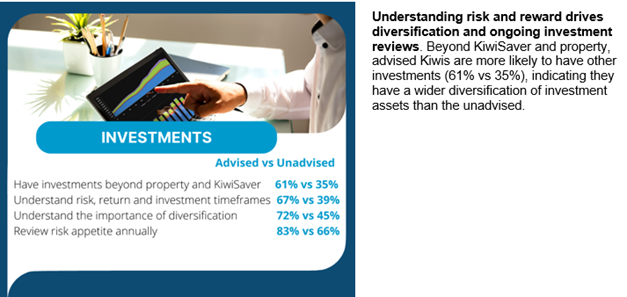

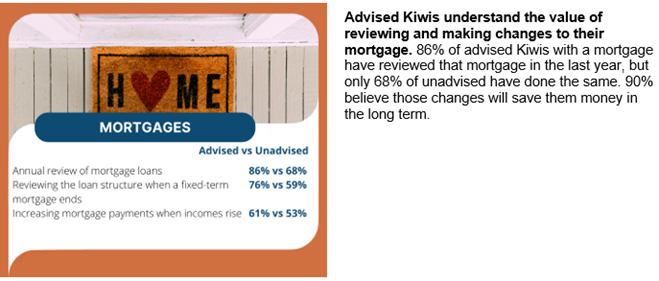

The Better Behaviours results clearly illustrate that advised Kiwis are more likely to have a documented budget and financial plan, to review their financial products regularly, to understand risk vs return, and to take-up and cancel insurance products when appropriate. They are also more likely to have positive mortgage behaviours, setting themselves up to save interest and carve years off the life of their mortgages.

Across the board (mortgage advice, investment advice, insurance advice and financial planning), quality financial advice has given Kiwis the tools to think about their finances in a pro-active way, given them more financial confidence and control, and has had a significant effect on their sense of financial wellbeing.

Download the full report here , however, for a snapshot of the results:

Source: https://financialadvice.nz/better-behaviours-2/