Budgeting and Cashflow

“I spent a lot of money on booze, birds and fast cars. The rest I just squandered”. George Best.

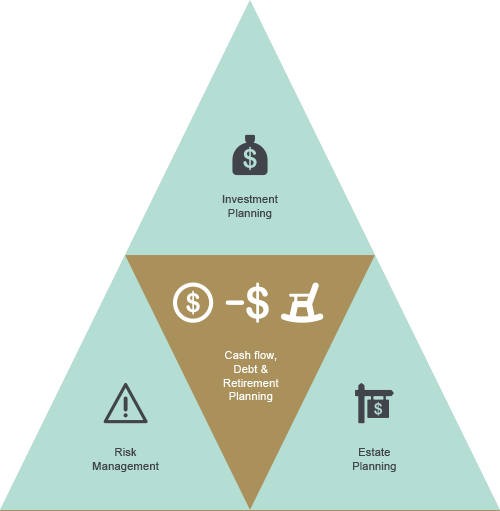

At the heart of any financial plan is cash flow. What money you earn and how this is best used is the most important area of any planning process. Good cash flow management involves knowing where your money is being spent, where economies can be made and employing the surplus to best advantage.

We use tools and techniques to ensure debt is repaid as quickly and efficiently as possible, whilst allowing you to invest and plan for your future passive income.

Pots of Money

We suggest you start to think of your financial resources exactly like this: pots of money. You should budget according to when you get paid: weekly, fortnightly or monthly. You may also be fortunate enough to receive bonuses.

The following diagram depicts these pots. Your income should go to the first pot. All your set expenses like mortgage, rates, power, telephone and fixed costs should come out of this account automatically.

Pot two will be your investments and savings (these will be split separately) and the last pot is what’s left for you to spend on whatever takes your fancy. Some clients like to have multiple ‘pots’ for different expense and savings needs.

It is important to review your income and spending regularly as the aim is to build up a surplus for future financial commitments such as paying extra to your mortgage and saving for children’s education costs, special holidays. Also, investing regularly to build up your wealth for when you will need to use it in retirement is important.

How can we assist?

As part of an comprehensive financial plan, we help explain what you need to do to work through your budgeting. We talk through what your expenses will look like in retirement, advise on investments and discuss the income you’ll need in the future in order to pay for your expenses and the lifestyle you want throughout your retirement years.