Recent Market Volitility October 2018

In the first three weeks of January 2018 alone the S&P 500 crossed ten new record closing highs in 13 days of trading. Then, in February, the index lost all its gains from 2018 in a few days. Over the next 7 months it built up gains again, and then lost all of them over the course of three weeks in October. What’s going on?

Let’s remind ourselves how markets work

Prices went down because someone was willing to buy at the discounted price. The buyer did not buy in order to lose money. The buyer bought because they felt that the discounted prices offered them enough return to justify the risk.

Markets bring optimists and pessimists together in equilibrium – they completely balance each other at a competitive price.

This is our shorthand way of saying at least half the market participants transacting in the last few days thought it was a good time to buy. Not everyone believes the sky is falling, even if the sensational headlines promote such a view.

But what about our investors?

For our clients with a 50/50 portfolio, we recommend a seven-year time horizon at a minimum, and most have a 20 or 30 year time horizon. In other words, any of our investors that are planning to spend money out of their portfolio this year or next year probably have that money sitting in bonds and cash, not in shares.

So, the portion of the portfolio suffering the most from this recent volatility is the portion that an investor has almost no chance of spending or using any time soon. That’s important, because it means that, whilst it’s not particularly comfortable to see volatility like this, it has little practical implication on their portfolio or current lifestyle. For most of our clients, we hope they’d look on this current situation with a level of disinterest.

For clients that are regularly purchasing assets in their portfolios or via KiwiSaver, this is actually a positive development, because they’ll be able to buy more shares with their same regular savings contribution and that will help grow their long-term wealth.

And let’s remember, when we signed up for shares, we accepted this would generally lead to more volatile returns. However, it’s volatility such as this that gives shares their wonderful return characteristics. Without temporary dips such as this most recent one, shares would have the returns of cash – which would not help us reach our financial goals.

The other point we need to make about the recent correction is that it’s not an unusual event. It is always extremely disappointing when markets go down, but as we’ve said many times, markets rarely go anywhere in a straight line. It is also the case that we cannot strive to achieve consistently higher returns than bank interest rates without assuming a higher risk that sometimes those returns will be lower than we would like; even negative.

The point is, what happened in the last quarter of 2018 is not new. It has happened before, and it will happen again. Having that knowledge is part of what makes a successful long-term strategic investor. It’s having an understanding and acceptance (at least a grudging one), that sometimes returns will be negative. We need to have this understanding, because otherwise our emotional response to difficult markets may prompt us to want to do the wrong thing at the wrong time. Quite often that can be far more damaging to a long-term investment plan than a temporary market correction.

We also need reminding because, as human beings, we are all prone to what is know as recency bias. We tend to overemphasise the most recent data and extrapolate that into the future (usually incorrectly) while at the same time undervaluing long-term trends.

Shares are volatile. The chart below shows the quarterly return of a 98% share portfolio. It goes up and down a lot; there’s no way around it.

The chart below, however, shows the growth of wealth this same portfolio has produced since 1991. While the volatility was uncomfortable, it produced large growth despite the Asian financial crisis, the tech wreck, the GFC and anything else you want to throw into the last 20 years or so.

The really critical point to remember in all this is the outcome that long term investors get to experience. It’s that share markets, on average, go up, and that consistent exposure to these markets is a key driver of long-term wealth creation. If there were no higher risk investment options available to us there would be no prospect of ever achieving a higher return.

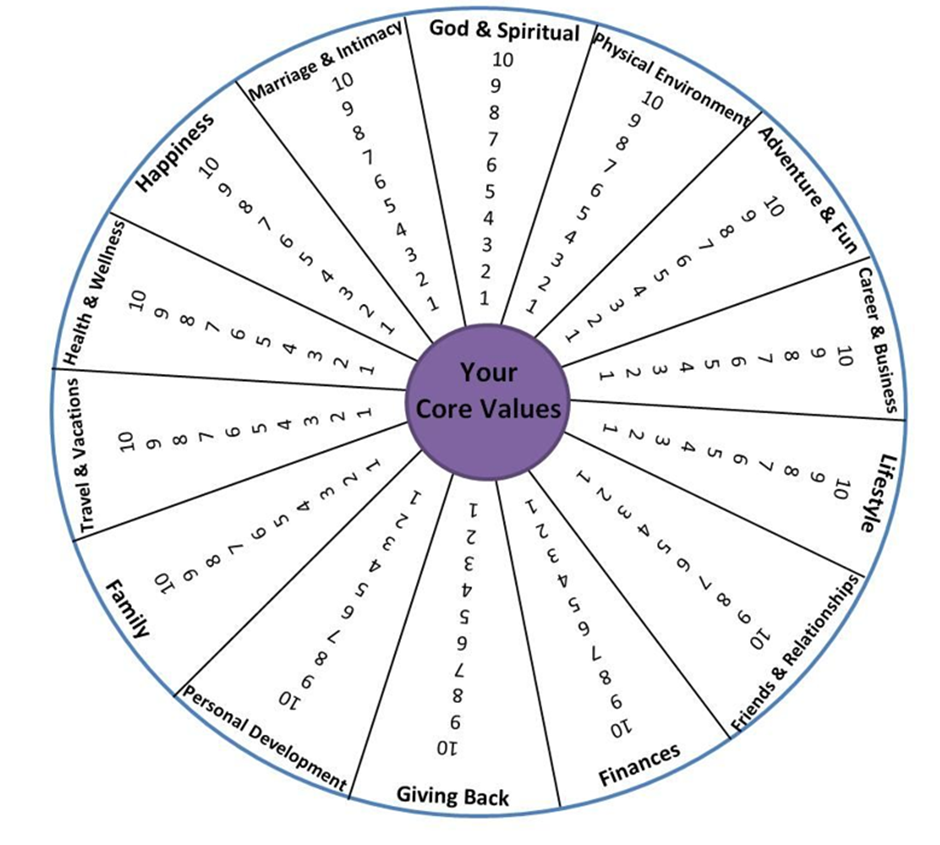

In order to achieve higher long term expected returns and hopefully give yourself more retirement options you need to be exposed to a measured amount of higher investment risk consistent with your time horizon and your risk tolerance levels. Sound investment strategy doesn’t change just because market conditions do. Sound investment strategy includes a clear understanding and acceptance that changing market conditions are unavoidably part of the bargain in order to achieve your long-term goals.

We know the markets can be volatile in the short term, but this is already factored in to our long-term strategies. The worst decision investors can make is to react to short term volatility in a way that jeopardises the achievement of their long-term plans.

If you are still concerned, we want to talk to you. Give us a ring and let’s have a chat, so we can give you the confidence you need.

Source: Ben Brinkerhoff, Consilium

Share This:

More Blog Posts:

Beware the hidden costs of indexing

Beware the hidden costs of indexing Insurance Premiums - why are they increasing so much?!

Insurance Premiums - why are they increasing so much?!

When the Face You Trust Is Fake: Why Deepfakes & AI-Driven Scams Are a Real Threat

When the Face You Trust Is Fake: Why Deepfakes & AI-Driven Scams Are a Real Threat